Have You Heard? gold in an ira Is Your Best Bet To Grow

Attention-grabbing Ways To best gold ira companies

May 24, 2023Master The Art Of investing in a gold ira With These 3 Tips

May 24, 20238 Best Gold IRA Companies Reviews, Fees, Comparison

You won’t earn dividends with a gold investment as you would with stocks, but gold IRAs provide some protection in the face of inflation and recession. This is in the range of most competitors, although there is at least one firm without an annual administrative fee. If you’re interested in a gold IRA investment, you may be wondering which company to choose from. So whether you’re looking to add gold and silver to your retirement portfolio or simply want to purchase some precious metal coins or bars, Goldco can help you meet your retirement goals. We have summarized the other positives here. Since Augusta isn’t technically the manager of your account, they don’t charge any management fees. Treasury, and America the Beautiful coins all have IRS approval. Gold IRAs allow investors to own physical gold, silver, platinum, and palladium, as well as other precious metals. A gold IRA requires a specialized custodian that can handle all of the necessary tax documentation and reporting, as well as deal with gold sellers, depositories, and shipping companies. You should also think about diversifying your precious metals IRA portfolio when investing with a gold IRA company. If done correctly, you shouldn’t incur any tax penalties for this movement of funds, but you will need to fill out several forms to complete the transition. Also, gold is a physical asset you can sell outside the banking system, which may provide a sense of security if recent bank closures have you concerned.

Ash and Pri

This individual will facilitate all of your interactions for the entire time you’re with the company. American Hartford Gold Group offers a full suite of services to help individuals and families invest in gold and silver IRAs. Why we like Goldco:Goldco has one of the best buyback guarantee programs. The The Las Vegas Review-Journal process is relatively simple and can be done quickly. This can be done through a rollover from another retirement account or by making a direct contribution. Birch Gold has a team of experienced professionals who provide personalized guidance and advice when it comes to gold IRA investments. If you think you need big bucks to open a gold IRA, think again: Orion has an order minimum of $5,000 — some other gold IRA companies have minimums of $50,000. The annual maintenance fee with this provider is estimated at $1 per every $1,000 invested with a $75 minimum. Augusta Precious Metals is a great choice for those looking to rollover a gold IRA. How To Start A Goldco Precious Metals IRA. It’s important to note that not all custodians offer the same types of metals or investment options, so investors should choose a custodian that aligns with their investment goals and preferences. IRA Amount Options: $500 to $1,000,000. Q: What are the benefits of investing in gold.

Gold IRA financial stability

We have researched so many gold IRA companies that it takes a lot to make one stand out from the rest. Experience Unparalleled Service with Gold Alliance. Second, the account holder contacts their preferred precious metals IRA company to formally initiate the transfer of funds. Most gold IRA companies charge a setup fee, and they also charge a yearly maintenance fee. Be wary of reviews that are overly positive or negative, as these may be biased or inaccurate. Here are some of the most compelling reasons you should consider investing in gold for retirement. Each of these gold investment companies has the expertise and knowledge to help you achieve the retirement of your dreams. Known for: “White glove” customer service. Here’s what we like most about Goldco. There is a reason why gold has been an investment choice for millennia. Wide selection of products. Q: How do I know if my gold backed IRA is safe. Choosing a suitable gold IRA company is essential to achieve your retirement goals.

Visually told More

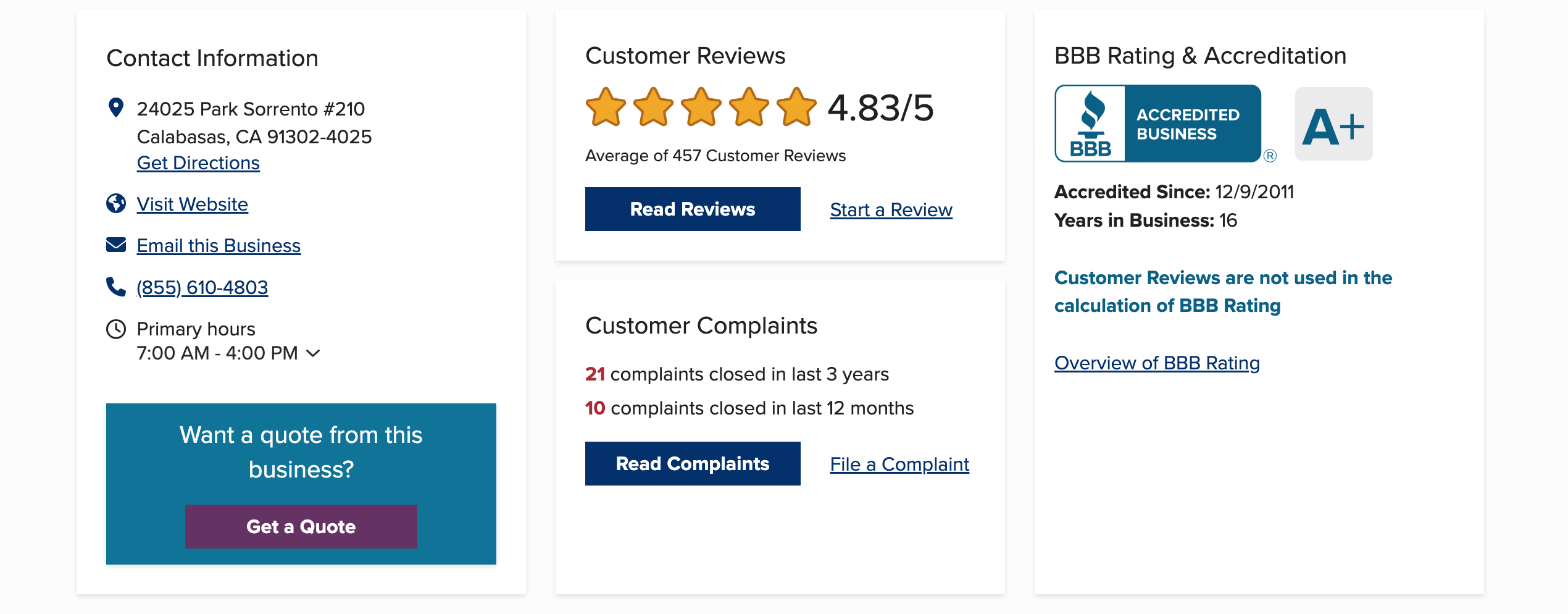

Discover the Benefits of Investing with Lear Capital Today. Gold is a physical asset that you can hold in your hand. It has also racked up fans, followers, and plenty of positive testimonials from users, as well as an A+ from the Better Business Bureau and an AAA rating from the Business Consumer Alliance. We do however, believe Advantage Gold is a reputable firm that will still be around in another 10 years. These are riskier, more complex, and come with costs that aren’t easy to decipher. You won’t find as much variety if you’re looking at platinum or palladium. For this reason it is wise to work with a company that has expertise in these areas. Since various depositories have differing storage fees, having a choice in the matter can save you some money on your annual IRA costs. While this option might entail shipping costs, you can sell your gold on the market at your discretion. Invest in Your Future with GoldCo: A Trusted Name in Precious Metals Investment. All of these can add up to a significant amount. The company seeks to improve the gold IRA investing experience by providing education and top level customer service. Gold Fields has total attributable annual gold equivalent production of 2. Investing in a precious metals IRA offers several advantages over traditional retirement accounts.

Invest in Physical Gold and Silver in Your IRA

With the help of this list, investors can make an informed decision when selecting an IRA custodian for gold and be confident that their gold IRA investments are in the right hands. Click here to learn more about Noble Gold. You’ll also have to budget for annual custodial fees, which tend to be higher than traditional IRA management costs. If you face any challenges, just one quick phone call and you will be assisted by a member of its support team. When it comes to retirement planning, many Americans rely on traditional IRA accounts. Your email address will not be published. You can choose between the Brinks Depository in Salt Lake City, Utah, or the Delaware Depository in Wilmington, Delaware. Their commitment to providing excellent customer service, their wide selection of gold and other precious metals, and their competitive pricing make them one of the best gold IRA companies. Some investors also qualify for free storage through Goldco. Opening an IRA might make you enjoy a broader investment range than a 401k plan. However, you can choose to work with these custodians or different ones. We only endorse products that we truly believe in. However, buyback prices may vary, and regulations prohibit the company from making buyback guarantees. When you’re ready to start the gold IRA process, you can’t go wrong with these recommendations for the best gold IRA companies.

Gold

American Hartford Gold Group is one of the most trusted names in gold IRA investing. Investing in a gold IRA is a great way to diversify your portfolio and hedge against inflation. Noble Gold is a leading provider of gold and silver IRAs, offering customers a secure and reliable way to invest in precious metals. Gold IRA reviews can help you find the right custodian or broker for your needs. They offer a wide range of services, such as precious metals investment, retirement accounts, and IRA rollovers. Q: What is a gold IRA custodian. We regularly update our list of best gold IRA companies to ensure that our highlighted picks continue to meet these requirements. The second option is a purchase by the depository, whereby the storage facility will buy your requested gold withdrawal at a price that closely mirrors the current market value. If you’re interested in creating an account of your own, you need to be aware of these businesses to make the best decision. Invest in Your Future with Birch Gold: Secure Your Financial Freedom Today.

GoldCo: IRA Accounts Best Gold IRA Companies

Your web browser is no longer supported by Microsoft. The three easy steps allow first time gold IRA investors who, perhaps, need hand holding through the process, the security and reassurance they are making an excellent decision. Precious metals IRAs are a type of self directed ira account, which means that the account holder has more control over his or her investment choices. What’s the outcome of this Oxford Gold Group review. So, what exactly are precious metals IRAs. Buyback programs take the hassle out of liquidation, allowing you to get cash for your gold without even having the gold shipped to you. If an investor already has a retirement account such as a 401k, a Roth IRA, or a traditional IRA, it is possible to arrange a rollover toward a gold IRA with the company you select. While all the best Gold IRA companies will provide a dedicated account executive to guide and help individual investors in getting the most out of their retirement funds, only a few companies will make you feel like royalty. They can also help you with any questions or concerns you may have about investing in gold. This company has earned a positive reputation as one of the top gold IRA companies in the industry. American Hartford Gold is one of the leading gold and silver companies in the country, delivering more than $1 billion in precious metals. You can feel more confident about your decision by comparing reviews and asking for clarification. All IRS approved gold and silver must meet specific IRS fineness standards. A: A Gold IRA Rollover provides investors with a number of benefits, including the potential for diversifying their retirement portfolio, the potential for increased returns, and the ability to protect their retirement savings against inflation.

Lear Capital: IRA Accounts Gold Backed IRA

While you can expect to pay some fees with any gold IRA company, some charge more than others. If you’re unsure of which metals best suit your investment, Birch Gold Group’s educational website pages offer an explanation of which metals are best for which kinds of investments and why. The company also offers competitive prices, making them one of the best gold IRA companies in the market. The best gold IRA companies will have a reputation for providing excellent customer service and expertise. With their gold IRA rollovers guide, clients can be sure that they are getting the most out of their gold IRA rollover investments. Secure Your Financial Future with Gold Alliance Top Tier Precious Metals Investment Solutions. Read our comprehensive Lexi Capital Review to learn more.

Head Office

When you open a gold IRA account with Augusta, you have the liberty to choose from one of the several insured depositories. Secure Your Retirement with Advantage Gold: The Trusted Precious Metals IRA Company. Read my Goldco review to learn more. There are plenty of customer review websites these days: Google Reviews, the Better Business Bureau, and Yelp. The good news is that this timeline is usually fast enough for most people who want to invest in gold. Best for a good selection of gold, silver, and platinum. Discover the Value of Investing in Augusta Precious Metals Today.

What is Gold IRA

They are always at hand to offer genuine and practical advice to clients. PLEASE NOTE: whilst we endevaour to ensure all content is correct and factual, We Heart accepts content from guest contributers and we cannot be held responsible for all content found on the website. The information on BMOGAM Viewpoints could be different from what you find when visiting a third party website. High quality products. There are quite a few differences between a precious metals IRA and a standard IRA to make the latter a bit complicated to set up. There’s a caveat, however: you have to make sure that what you are buying passes IRS standards and is an approved precious metals. Gold, silver, platinum, and palladium coins and bars that meet IRS purity requirements. You can invest in gold using various methods, including buying physical gold, exchange traded funds ETF and gold mining stocks.

Blog and Articles

The representative we spoke with informed us that the first year fee would be $260, followed by an annual fee of $180 for each year after that. The account manager isn’t your regular brokerage firm, as traditional businesses do not offer gold IRA services. If a gold IRA is closed without transferring the investment to another account, an average fee of $150 is imposed. Their expertise and commitment to excellence make them one of the top gold IRA companies, providing customers with a safe and secure way to invest in gold. Investing in gold for retirement can help you achieve your financial goals and secure your financial future. English Composition I and IIModern Literature I and IIAdvanced Expository Writing.

CONS

If you want to have a good experience with your gold investment company, make sure to choose one that other people say is reputable. To help you find the best gold IRA company, we’ve reviewed the top precious metals IRA companies in the industry. Though Noble Gold is the last option on our list, that doesn’t take away from the company’s excellence. As Eric Smith, a spokesman for the IRS explains, “the assets must be held by a custodian in the U. ITrustCapital sources its gold and silver offerings from Kitco, and it says it ledgers transactions on the blockchain through Tradewind’s VaultChain platform. In fact, many investors have multiple accounts because of how they’ve diversified their portfolios. These companies will help with the paperwork, connect you with a custodian, and, most importantly, assist you in buying the preferred precious metals for your IRA account. In addition to maintaining e books and videos, the company also maintains an in depth blog that covers a range of topics on investment. An IRA is different from a 401k which can only be opened by an employer. While some companies offer buyback programs, others will ship your gold to you and leave you on your own to sell it.

Welcome Bonus

Its customer service is outstanding, and its fees are competitive. Goldco’s process is designed to help you make informed decisions about your retirement portfolio. When they’re selling standard bullion, the price is 5% higher than the spot price. Next, many IRA companies charge an annual administrative fee that covers the cost of keeping your account open year after year. Plus, precious metals aren’t always recession proof, despite what some people may believe. Ensure that their representatives are knowledgeable about their services and will provide prompt assistance when needed. Here are some selling points. Gold IRA companies charge different types of fees as part of their business due to how the service works. Your best option should be in a nearby location and charge fees that fit your budget. Some custodians may allow you to take possession of the metals, while others may only allow you to view them.

ReadLocal

They make it easy to build wealth and help new customers like yourself get into these investments. The package will then be sent to your depository, and most importantly, processed completely free of charge. They will also help you manage your account, process payments, and answer any questions you may have. They also provide the investor with access to their gold IRA funds and facilitate transactions. Storage including insurance ranges from $150 to $200 annually. Their customer service team is available to assist customers 24/7, ensuring a smooth and successful gold IRA rollover. Ownership of the precious metals is further removed with an ETF. In accordance with Internal Revenue Code Section 408m, a custodian approved by the IRS or a financial institution is required to physically hold precious metals IRA.

Remember

A: A precious metals IRA offers investors the ability to diversify their retirement portfolio and hedge against market volatility. They also provide secure storage for gold investments, ensuring that customers’ investments are safe. For instance, investing in other commodities instead of only bonds ensure that you have a safety net when other assets gain value and the bonds tank. Great Value based on our staff’s judgment. For example, you may be able to roll over your distribution into another IRA or qualified retirement plan. You probably heard their commercial on Fox News. Free IRA set up and storage. Our main reason for highlighting this company is its quality customer service support. This includes American Silver Eagles, America the Beautiful, and Canadian Silver Maple Leaf. No online purchases available; must speak with a company representative. No physical store locations. The Augusta Precious Metals website also includes a video resource library filled with helpful videos from Delvyn Steele, a Harvard trained economist. Experience Patriot Gold and Enjoy Unparalleled Security and Peace of Mind. This service usually features direct access to a gold investment specialist who will usually guide each customer through all investment processes.

Take Us With You

In this article, you’ll find a concise review of some of the best gold IRA companies you can approach today. And so more money printing will become a necessity. Discover the Value of Precious Metals with Augusta Precious Metals Today. There are many ways to invest in gold, and a gold IRA is one of them. Augusta Precious Metals is another well established company you’ll want to consider for your precious metals investment. Experience the Quality of Augusta Precious Metals: Invest in Value Today. As a large, well connected gold IRA company, Oxford Gold Group sells precious metals from several global mints, including the U.

Greg

If you haven’t considered incorporating precious. Explore the Top Notch IRA Precious Metals Services from RC Bullion Today. Additionally, it is used in groundwater treatment, medicine, jewelry, dentistry, and certain chemical processes. Since gold IRAs are technically self directed IRAs, gold bars and coins aren’t the only things you can hold in these accounts. Birch Gold Group provides investment options, including precious physical metals, self directed Individual Retirement Accounts IRAs, and gold and silver numismatic coins. Get started with Augusta Precious Metals. ReputationCelebrity endorsements may make a strong impression. The gold investment company has earned its high rating due to its reliable customer service and dedication to secure gold investments IRA. You’ve probably heard of 401k and traditional IRA accounts.