Attention-grabbing Ways To best gold ira companies

3 Easy Ways To Make best gold ira companies Faster

May 24, 2023Have You Heard? gold in an ira Is Your Best Bet To Grow

May 24, 2023Should You Open a Gold IRA? Here’s What You Need To Know

If you wish to roll over an existing IRA or 401k into a precious metals IRA, an IRA specialist at Goldco will help you through the process. You need to decide how much of a risk you’re willing to take and what you want your gold IRA to do for you. Or Canadian Treasury that meet IRA requirements for purity and provides storage at several IRS approved depositories. Use our retirement calculator to stay on top of your savings. 9999 silver bars, or any gold coins will appreciate at all or appreciate sufficiently to produce a profit above and beyond the mark up/ commissions charged whether they are bought for direct delivery or inside of a precious metals IRA. The top technologies used by The Gold IRA Company are jQuery , Font Awesome and Bootstrap. Discover the Power of Precious Metals with American Hartford Gold Group. You can even store paper investments, such as stocks in gold mining companies or mutual funds related to gold prices, in your gold IRA, making it an even more diversified investment vehicle. Birch Gold requires a minimum investment of $10,000 on your initial account setup. They have received 4. Read full review of Regal Assets.

2 American Hartford Gold: Best for New Investors

The rollover transfers value from a traditional retirement account to your gold IRA. You are expected to spend up to gold IRA companies $300. Internal Revenue Code requirements state that the approved precious metals must be stored in a specific manner. Finally, the company you consider must be highly renowned and endorsed by different independent review bodies in the industry such as BBB and TrustLink – with minimal or no complaints. Either of these actions is considered an IRA distribution. Lifetime customer support.

As of

GoldBroker is an exceptional choice for those looking for gold IRA custodians. They are as follows. They offer an extensive selection of gold and silver coins, bars and rounds, as well as knowledgeable, friendly staff who are always willing to answer any questions. As a consequence of this Act, the IRS expanded the IRA allowable precious metal holdings to include 1, ½, ¼, or one tenth ounce U. Click Here to Learn More About Goldco. The companies will also provide assistance with the storage and security of your precious metals. Gold backed IRAs are also known for their tax advantages, as they are not subject to capital gains taxes. Factors to consider include the company’s reputation, fees, customer service and the range of services offered. Today, it is one of the best IRA gold company with the large customer base. It could take 3 to 5 days before any order is cleared and a week for shipping to arrive. Your financial advisor will help you decide whether gold will take you where you would like to go before reaching out to a specialized gold IRA company to take the next steps to make gold purchases. 5% pure or better and silver bars must be 99.

10 Birch Gold Group: Best For Gold and Silver IRA

Brinks is a world renowned security and logistics company that provides storage solutions for precious metals. Discover the Power of Advantage Gold for Your Investment Strategy. Gold has always been considered valuable since its discovery. The login page will open in a new tab. If you happen to find yourself in the state of Texas, you’ll enjoy the added bonus of having your gold IRA nearby. Additionally, its competitive pricing makes it one of the most cost effective gold IRA companies on the market.

8 Gold Alliance: Best For Storage Options

The company’s financial advisors are knowledgeable, experienced, and always available to provide assistance and advice. Silver requirements are even more stringent, requiring 99. In total, the company has seven filed complaints by its customers. So, your next best bet is accumulating assets that appreciate. Invest in Your Future with GoldCo: The Leading Gold IRA Custodian. Focus on education, including sending people a free coin to participate in a learning call. GoldCo Silver and Palladium IRA 3. Further, Goldco works with all major Self Directed IRA custodians. With a lightning fast IRA process, you can be investing in gold and silver in minutes. It also offers a buy back commitment and no back end fees, helping you feel more confident in your investment.

Why Invest In Gold IRAs?

Customers can also sell their metals to the company through a competitive buyback program. When you open an account, you’ll need to decide what type of gold you want to invest in. A gold IRA is a smart way to diversify your retirement portfolio and protect your investments against inflation. If you wish to withdraw from your gold IRA before you turn 59. Money is something people need for their daily life. Check out customer reviews to see how each company has performed when it comes to various customers’ needs. If you have any questions, the team provides answers in a timely fashion to help you make informed decisions. With over 20 years of experience, Lear Capital offers expert advice, an extensive range of IRA approved precious metals, and exceptional customer service. They also consider investment objectives and risk tolerance before giving you advice. INVESTMENT STRATEGIES. By simply requesting information about a gold IRA, you’ll receive a 1/10 oz gold coin, even if you choose not to set up an IRA account with the company. Secure Your Financial Future with Augusta Precious Metals: A Trusted Provider of Precious Metal Investments. Those with a rollover can contact the company through the 800 phone number.

Oxford Gold: Summary Gold IRA Rollover

American Hartford Gold charges a $180 annual fee that may be waived for up to three years if an investor’s precious metal purchases exceed $100,000. GoldCo is the best gold IRA custodian for those who want to invest in gold. A: A gold IRA custodian is a financial institution or other approved entity that has the authority to manage, administer, and protect an individual’s gold IRA account. They have great selection, amazing customer service and education, and are the most trustworthy company on this list with the best customer reviews. GoldCo, American Hartford Gold Group, Oxford Gold Group, and Lear Capital are all top tier providers of precious metals IRAs. How much gold should you have in your portfolio.

Obscure Way to Gain Access to Your IRA Funds Tax Free – Episode 389

Noble Gold has a terrific rapport with other professionals in the industry, so if you need a service it doesn’t offer, the team will gladly provide a referral. You can invest in silver bars or coins within your IRA account. Oxford Gold Group sells gold, silver, platinum, and palladium coins and bars that you can include in your IRA. With the help of this list, investors can make an informed decision when selecting an IRA custodian for gold and be confident that their gold IRA investments are in the right hands. Fortunately, Advantage Gold makes it easy through their work with two depositories that you can choose from. Investing in gold can be a smart way to diversify your portfolio, reduce your overall risk, and protect your wealth in the long run. Some self directed IRAs include cryptocurrency, art, and real estate. Q: What is a gold IRA custodian. In addition, Augusta provides all the information you need about your gold and silver purchases, working in your direction to grow your precious metals portfolio, overseeing buybacks, and fulfilling other precious metals requirements. So if you’re looking for an IRA custodian for gold, look no further than Gold Alliance.

Patriot Gold Club: Pros Gold Investment Company

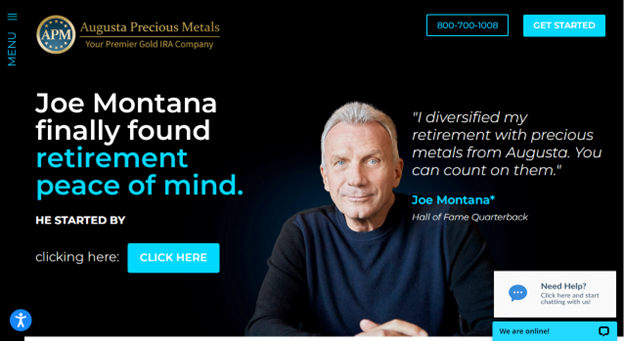

How much do you need to start a gold IRA. You will have a lifetime support agent while you are a buyer at Augusta Precious Metal. Choose Noble Gold for a secure and reliable gold IRA custodian and start investing in your future today. Augusta Precious Metals is committed to providing the best gold IRA experience possible, making them one of the best gold IRA companies available. Additionally, gold IRAs provide investors with the ability to transfer funds from one IRA to another. One is to have your account costs covered for up to 3 years with a qualifying purchase. Like the stock market or any investment, gold IRAs do have risks attached, though gold investing is historically more dependable. You can look into it and find out for yourself. Investors can also purchase physical gold and silver coins through these companies.

Investment Options

Gold has long been seen as a safe and reliable store of value, and gold IRAs offer a unique way to invest in gold. Abrdn expressly prohibits the dissemination, reproduction or transmission of any of the contents of this site in any form, other than for personal use. IRA contribution limits and rules are subject to change by the IRS. In Latin America, no securities regulator within Latin America has confirmed the accuracy of any information contained herein. Yet many investors are drawn to ETFs because they don’t necessarily need to be actively managed. Gold can also be taxed through inheritance taxes. Noble Gold Investments offers the following conditions.

What are the biggest advantages of investing in gold?

Self Directed Accounts. Offers transparent pricing and low fees. For example, during the financial crisis in 2008, gold prices rose 2 percent while the SandP 500 index plunged 37 percent. Precious Metals IRA with Litecoin 5. Gold IRA companies offer investors the opportunity to diversify their retirement savings by investing in a variety of gold and other precious metals. While money might not be built to be indestructible, it should be a solid commodity that does not evaporate when you are not looking or fall apart in your pocket. In 2022, Bitcoin declined roughly 70%.

PROS

This makes it an attractive option for those looking to hedge against inflation or economic uncertainty. Birch Gold Group established a solid reputation over nearly 20 years handling physical precious metals. All products are presented without warranty. Fusion Media would like to remind you that the data contained in this website is not necessarily real time nor accurate. Best of all, Birch waives the fees for all accounts over $50,000. Common fees include annual account maintenance fees, transaction fees, and storage fees. Start investing in gold now. When it comes to protecting your retirement account against market volatility, inflation, and a pending recession, a gold IRA or precious metals IRA may be one of the best options at your disposal. How to choose a gold IRA company. Here are some of the key benefits of investing in a gold IRA. But is the high account minimum right for you.

Anna Miller

You’ll also find over 500 reviews and a 4. Make sure to ask as one of these promotions might be enough incentive to choose one company over another. Make sure to evaluate an IRA custodian thoroughly before investing with it. Exploring the Benefits of Investing with Advantage Gold: A Must Try for Smart Investors. Experience GoldCo: The Best Choice for Quality and Value. All the companies on our list provide representatives to guide you throughout the setup process, ensuring that everything complies with IRS standards. If you have questions, you’ll get detailed answers in a timely fashion so you can make efficient and informed decisions. Web Developed by HappyDesk. They offer a wide variety of options and make the process of setting up and funding your account straightforward. The second option is a purchase by the depositary. Additionally, the fees associated with the gold IRA companies are another major factor in their ranking.

Take Us With You

The company’s nationwide reach allows them to assist a diverse range of investors in protecting and growing their wealth through precious metals investments. Patriot Gold Club is a reliable provider of gold backed IRA services. GoldBroker is a leading provider of gold IRA services and offers a range of options to help clients manage their retirement funds. We gave Regal Assets 4. With an experienced team of professionals and an impressive commitment to customer service, Oxford Gold stands out as an industry leader. They must pay income taxes on traditional IRA savings when making withdrawals in their retirement days. Gold has a long history of being a safe and profitable investment.

Warning

You can keep them at home with you, or in a secure, fully guarded depository. GoldCo: Your Partner for a Secure Financial Future with Reliable Gold IRA Services. For example, suppose you’re looking to sell some of your gold or silver to liquidate your account. Once you’ve created an account, you can always log in to see how your holdings are doing. The advice provided by our precious metal brokers is specifically tailored to your individual needs. To prevent a recession, the U. Protect your retirement savings with Goldco precious metals IRA. All in all, Lear Capital is a great gold investment company for those looking to add gold to their investment portfolio. At this time, a range of precious metals do meet specific purity requirements acceptable for gold IRA accounts. It enjoys a high rating from the BCA. This will vary based on which company you choose to do the 401k to Gold IRA rollover with. Investment fees: Some precious metals dealers may charge a fee to purchase the metals on behalf of your IRA. Their comprehensive services and knowledgeable team make them a great choice for those looking to invest in gold IRAs.

Types of gold you can hold in a precious metals IRA

The fee for the Oxford Gold Group’s services is rather high when compared to other companies. GoldBroker is a great choice for those looking for the best gold IRA companies. Free Silver American Hartford Gold offers up to $10,000 in free silver delivered to your front door, on qualifying purchases. Whether exposing you to taxes and penalties by not following IRS rules or simply not acting in your best interest, entrusting your retirement account to some firms can be just as risky as investing in only stocks and bonds. The fees are comparable with competitors, with a $50 initial setup charge, an $80 annual management fee, and a $100 storage fee. The unique one on one web conference designed by their Harvard trained economist is a “must watch. There are no fees for establishing a gold IRA or for shipping, and you may sell your gold bullion back under the company’s buyback program. It has the most customer reviews on our site from people who’ve invested with the company and worked with its team of professionals. American Hartford Gold is a family owned gold IRA company operating out of Los Angeles.